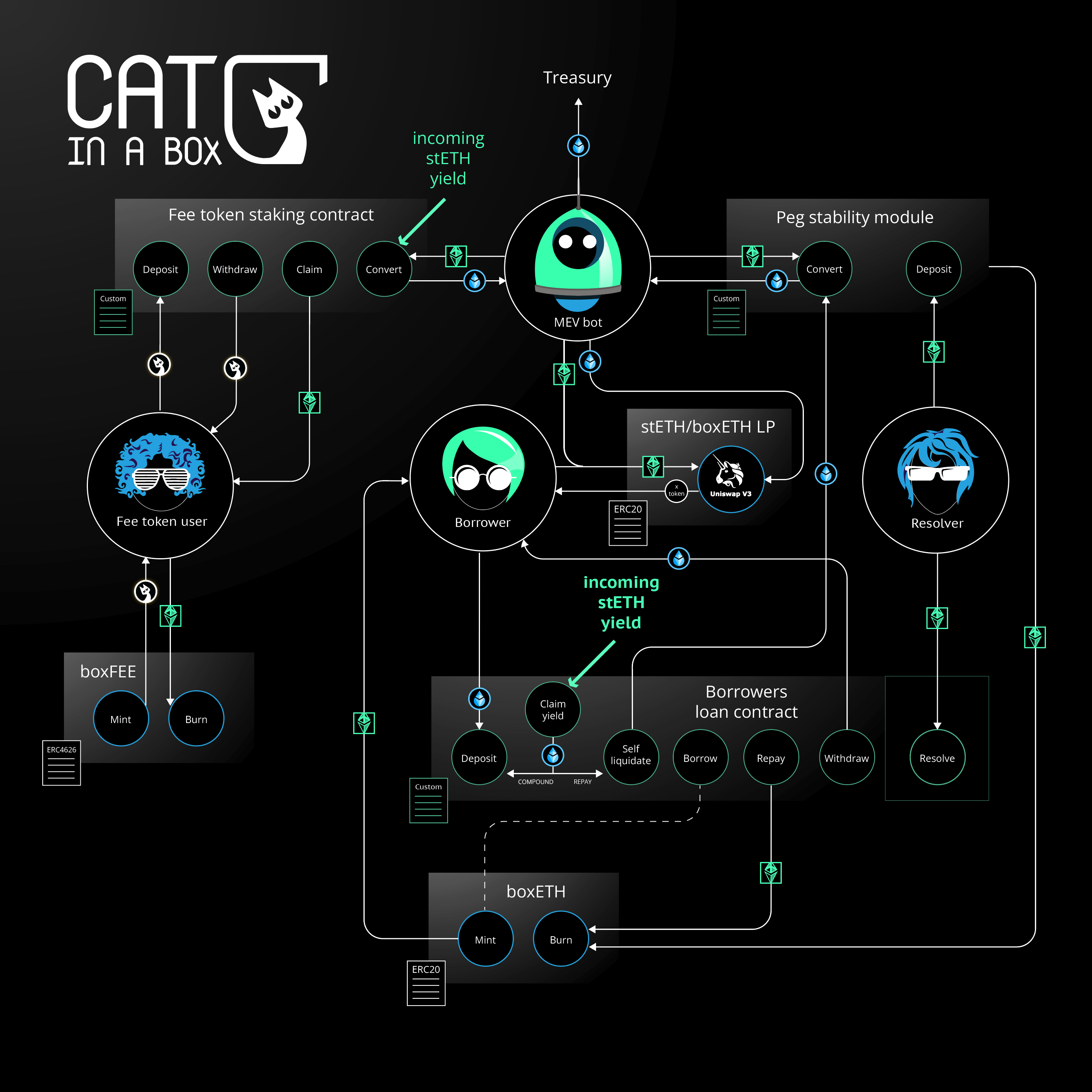

Components

Dynamic lending (collateralised debt positions)

Handled by the main smart contract where yield-bearing stETH is deposited and yield is accumulated for distribution. This is also where boxETH can be minted and borrowed 1:1 against the user’s deposit as collateral.

Yield is dependent on your CDP health - maintaining healthier than average collateralised debt positions (CDPs) is rewarded with boosted yield. User CDPs that have lower loan-to-value debt than the protocol’s global average will receive higher than normal staking yield rates.

Users who take on higher loan-to-value debt relative to global system debt will be at risk of having at least part of their collateral resolved in order to support the peg of the synthetic asset.

Peg-Stability Module

The Peg Stability Module (PSM) receives stETH that was used by borrowers to self-liquidate their loans.

The stability module controls burning of the synthetic boxETH against the stETH received, to ensure that the peg is supported by removing the synthetic boxETH from the open market. Any positive Extracted Value (EV) generated from this activity goes towards purchasing more boxETH from the open market, and is sent into the treasury.

The PSM also receives boxETH fees resolvers need to pay in order to resolve debt from a CDP. This boxETH buys boxFEE tokens and sends them into the treasury.

MEV Bot

An MEV bot is used to provide efficient conversion of stETH to boxETH.

It takes stETH from the Peg Stability Module and the fee token staking contract, and buys the maximum amount of boxETH possible from the open market. While the term MEV bot is used, it references the maximum extractable value in the form of boxETH and bot refers to the fact that it is semi to fully automated depending on improvements made by the team.

Resolver

The Resolver is an important actor in the protocol. When there is a liquidity imbalance in the synthetic’s liquidity pool the stETH-boxETH peg will experience downward pressure pushing it below the 1:1 valuation. The Resolver is then able to purchase the discounted boxETH from the open market which will push the peg back towards 1:1.

This boxETH can be used in the protocol to liquidate part of another user’s debt position. This process results in the self-stabilisation of the stETH-boxETH peg whilst benefiting the Resolver with a financial incentive and removing excess leverage from the protocol.

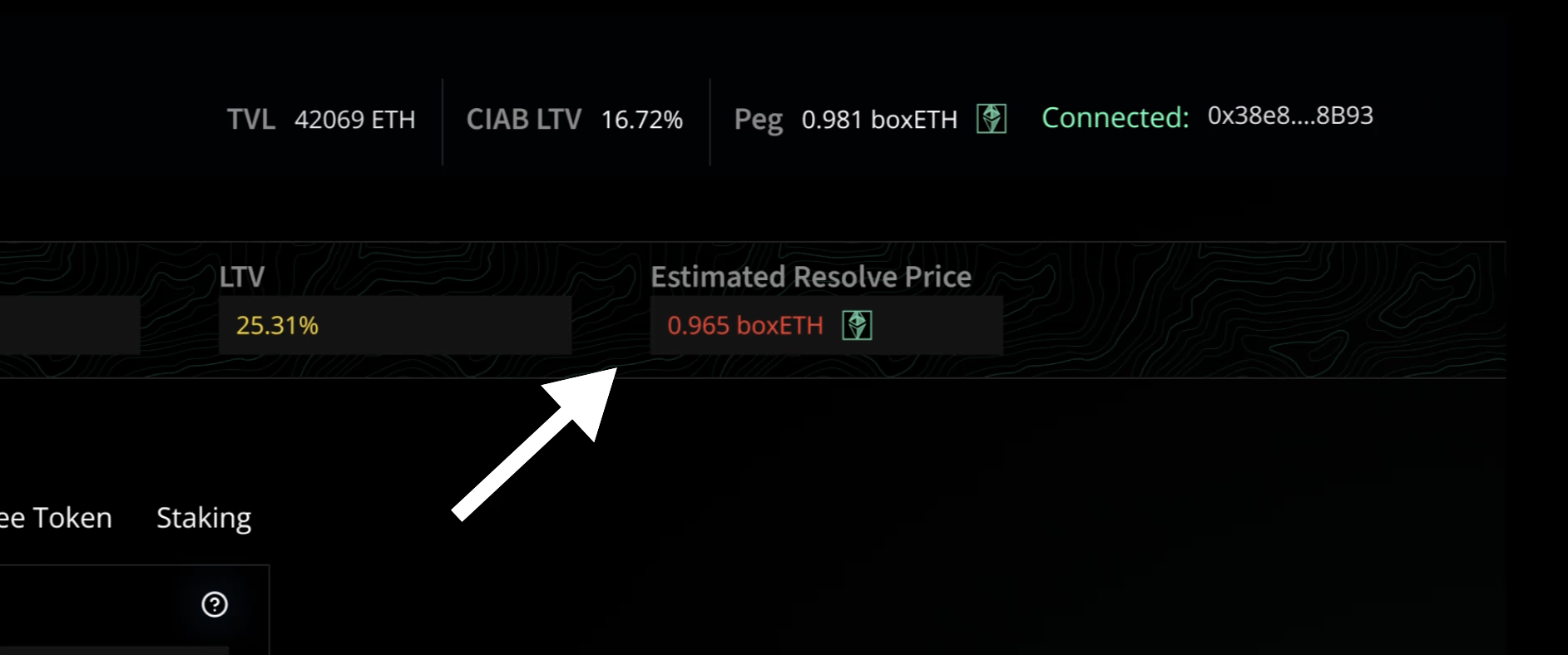

The price at which they can buy users' collateral depends on their LTV/debt position health rate.

Users' collateral is priced at 1.1 boxETH per 1 stETH at its healthiest, and trends towards 1:1 as its health worsens. The price at which a borrower's collateral becomes attractive to be resolved by another actor is displayed on their dashboard. This is known as the resolve price.

The resolve action burns 1:1 boxETH with the amount of debt that is getting closed. In order for the resolver to get that amount of stETH from their CDP. The additional boxETH the resolver pays as fees is sent to the PSM.

Fee token staking

The initial supply of the Cat-in-a-Box fee token (boxFEE) is distributed to liquidity providers who participate in the liquidity generation event (LGE). 1% of yield generated, and additional fees (up to 25%), are charged in correlation to the health of a users’ debt position.

fee token yield = x% of yield + (25% yield * debt / deposits)

x = 1 to 75% (set by admin, initial value set to 1)

These fees are redirected from the deposit smart contract to the fee token staking contract and distributed equally among all the stakers in the form of boxFee tokens.

After the initial launch and distribution, anyone can mint additional fee tokens 1:1 by paying with boxETH.

Fee tokens can be redeemed (burned) for their real-time value based on the boxFEE backing that has accumulated from new token mints.

Example: If there are 2000 boxFEE tokens baked by 1000 boxETH, then 2 boxFEE tokens can be redeemed for 1 boxETH.