User Guide

The steps to use the Cat-in-a-Box protocol are outlined below:

Deposit

The Cat-in-a-Box protocol is built on stETH as the main yield-generating asset. A user can simply deposit their stETH into the deposit contract and continue earning yield. Only 1%* of the yield a user would normally earn through stETH is redirected to the Cat-in-a-Box protocol. The upside of depositing stETH into Cat-in-a-Box is that the yield is boosted by a proportional share of all collateralised (deposits directly securing users debt) stETH in the protocol.

The yield in stETH earned can be claimed to compound the original deposit or used to repay a loan.

*1% of yield is taken based on the launch parameters of the smart contract. This is subject to change.

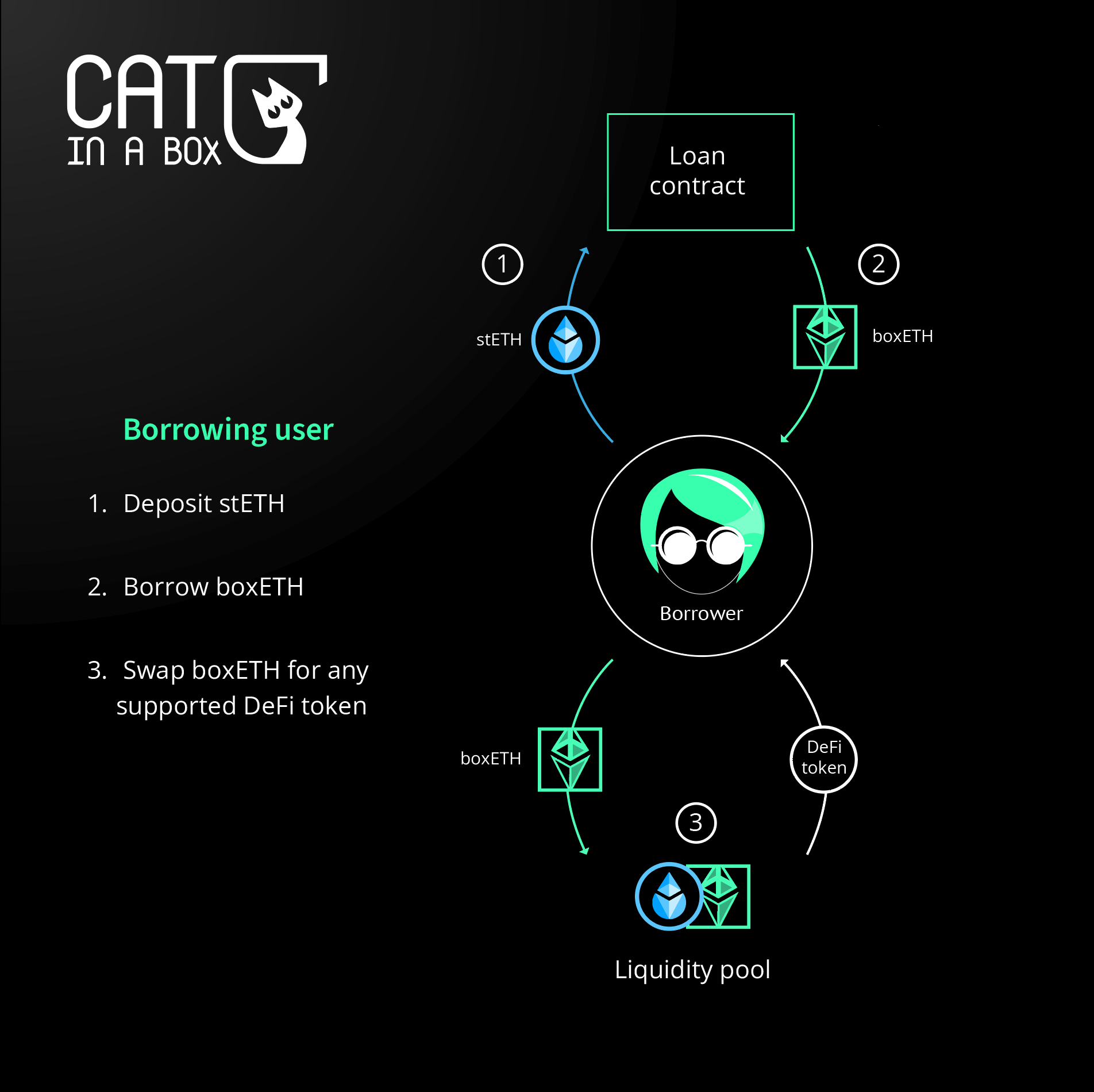

Borrow

Any stETH deposited in the smart contract can be used to mint and borrow a 1:1 soft pegged asset issued by the protocol as boxETH.

Once the borrower has taken a loan they can use it to:

- Convert it into an asset of choice on a DEX or DEX aggregator

- Resolve another users debt to earn arbitrage profit

- Purchase fee tokens

- Provide liquidity to the boxETH-stETH liquidity pool

Repay

Loans taken against deposited stETH can be repaid at any time without a penalty for early repayment.

The borrower can simply purchase boxETH from the liquidity pool and return it to the protocol, upon which the debt position’s health factor improves. As the debt position’s health improves, the over-collateralised portion of the users deposit benefits from additional yield.

Self-resolve

A borrower also has the option to pay back a part or the entirety of their loan with the over-collateralised portion of their deposit. The stETH used to self-resolve is collected by the Peg Stability Module.

See here for more about the Peg Stability Module.

Withdraw

Over-collateralised portions of the user's deposit can be withdrawn at any time.

If you have an ongoing loan, it is advised to leave some amount of stETH as excess collateral to avoid being resolved, in the case of a strong boxETH-depegged price. The health factor of your debt position is indicated on the UI dashboard labelled ‘Resolve Price’ which is also supported with colour coding. The resolve price indicated, shows the price at which a resolver is incentivised to buy up to 25% of your debt in the form of your collateral (boxETH) to pay down your debt.

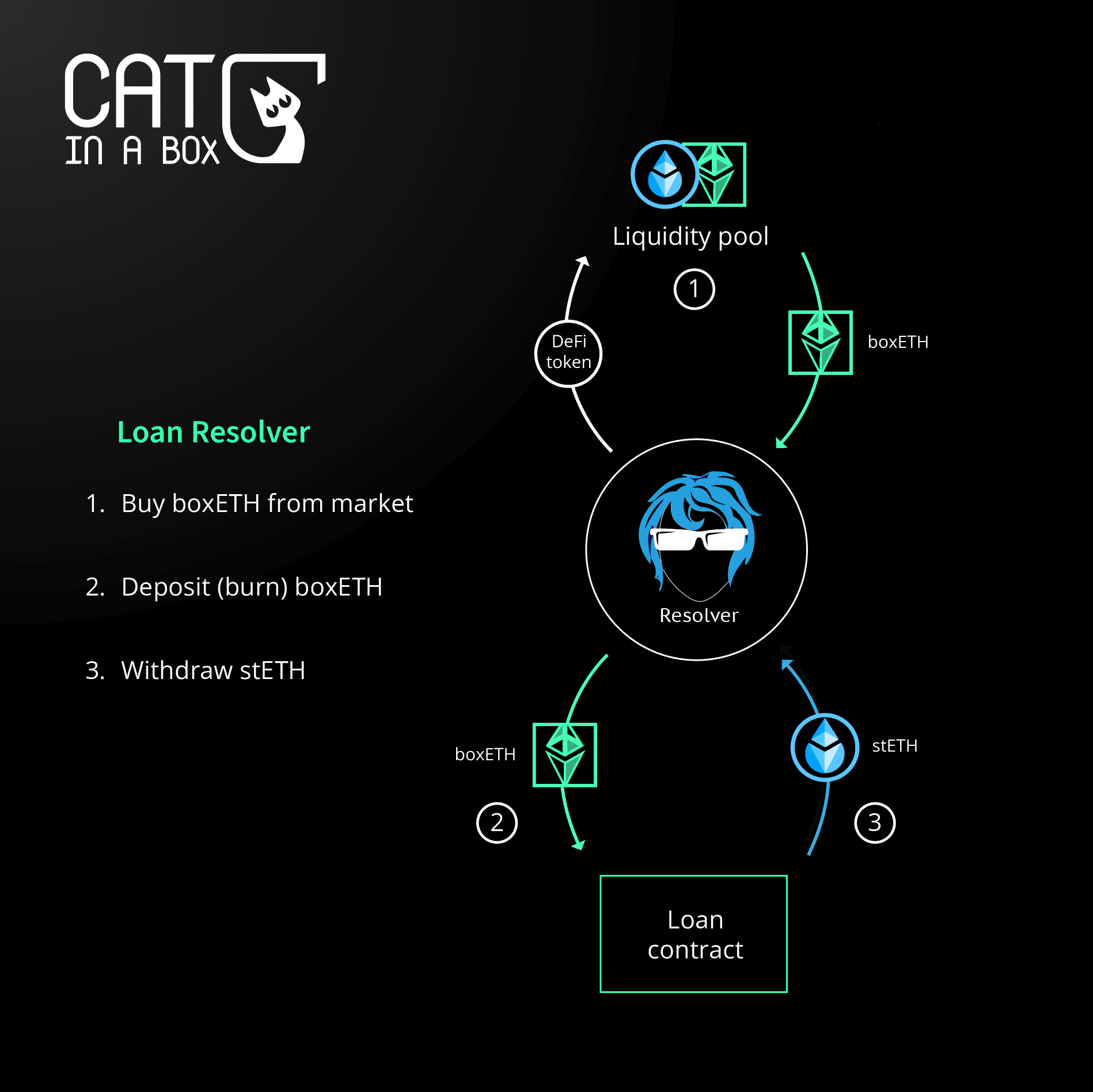

Resolve

In case of a strong boxETH-depegged price, a resolver can purchase the discounted boxETH with stETH. The resolver resolves a borrower’s debt position and repays it with this boxETH.

The resolver then receives the borrower’s collateral at the resolve price determined by the borrower’s CDP health factor. A maximum of 25% of outstanding debt can be resolved per transaction.

This activity contributes to maintaining the boxETH:stETH soft peg at 1:1 since the resolver will purchase the boxETH from the LP, adding upwards pressure to its peg.

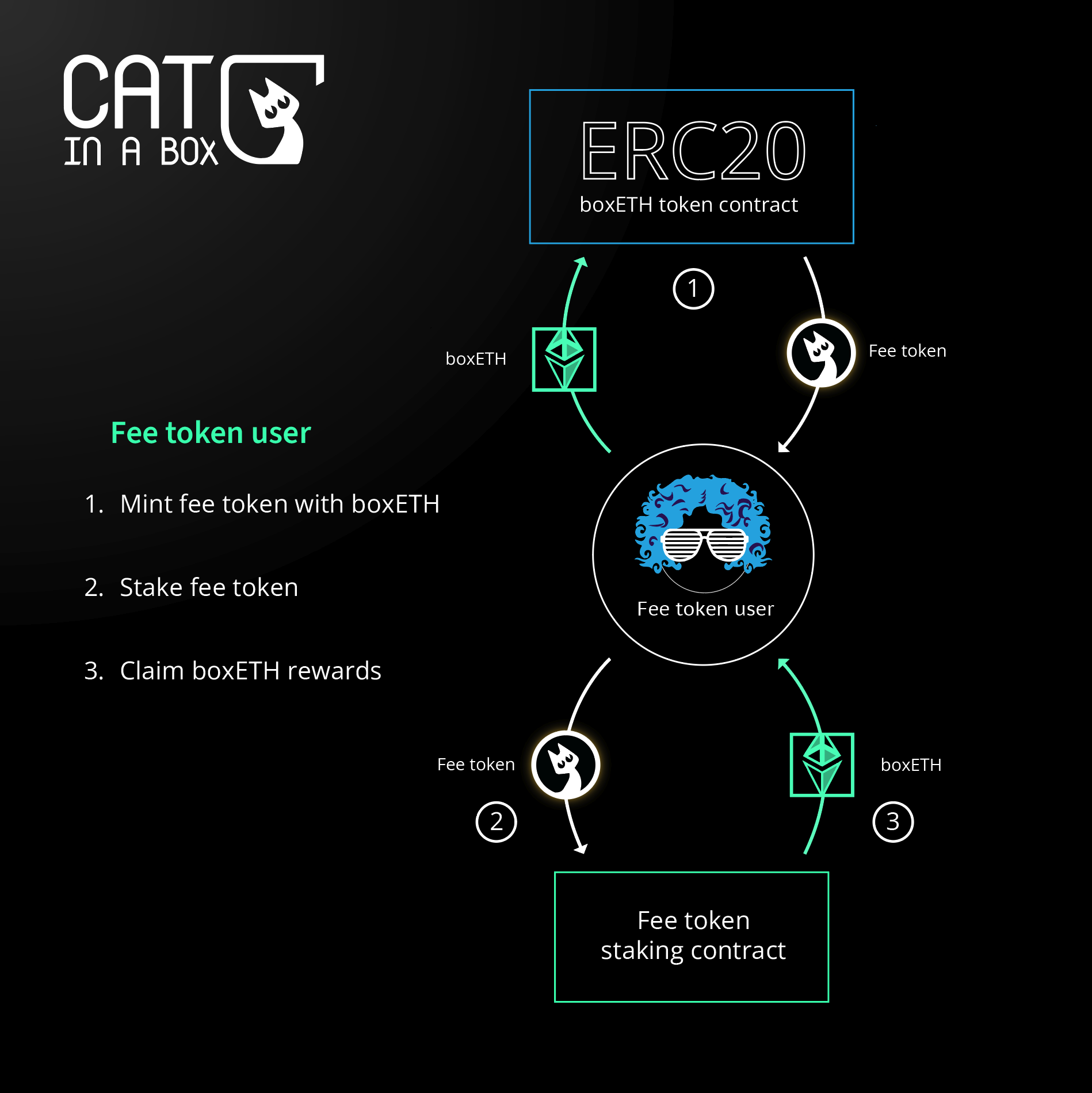

Fee-token

The initial supply of the boxFEE token is distributed to participants of the LGE. They may stake their boxFEE tokens to receive protocol fees calculated using the fee formula.

boxFEE can also be minted 1:1 against boxETH after launch directly from within the protocol. Fee Token Staking